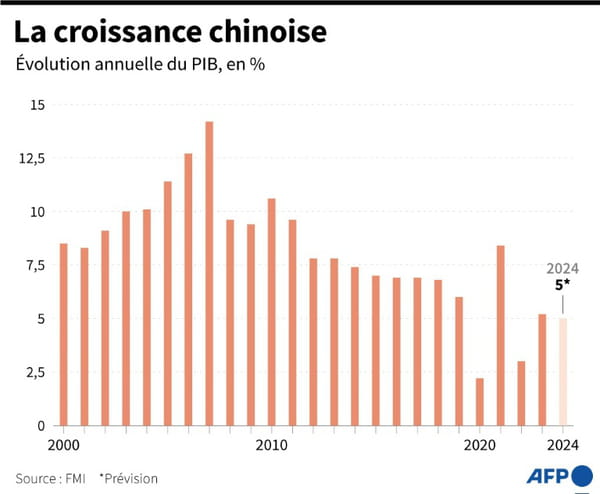

The International Monetary Fund (IMF) has noted Wednesday its growth forecast for China é 5% in 2024, but is nevertheless concerned about the challenges that remain on the industrial and budgetary levels. The world's second largest economy, which is still struggling to recover from the Covid years, is also penalized by a persistent debt crisis in the real estate market, which has long represented around a quarter of the country's gross domestic product (GDP). The decline in consumer spending and the risk of deflation are also weighing on Chinese economic growth. But there are now signs of recovery: in the first quarter, growth exceeded expectations, at 5.3% year-on-year, which the Chinese authorities described as a “good start”. China, which is still struggling to recover from the Covid years, is also penalized by a persistent debt crisis in the real estate market © AFP – JADE GAO This performance, as well as “recent political measures” by China, decided the IMF to raise its growth forecast for 2024 to 5% on Wednesday, in line with the objective set by Beijing in March. For 2025, the Fund expects 4.5%. The IMF previously forecast growth of 4.6% this year in China, but it is showing more optimistic due to the measures taken by Beijing in recent weeks to stimulate the real estate market. “The ongoing housing market correction, necessary to steer the sector towards a more sustainable path, is likely to continue,” the organization believes. Chinese growth © AFP – Gustavo IZUS, Gabriela VAZ However, “a more comprehensive set of measures would facilitate an efficient and less costly transition while protecting against the risks of deterioration” of the market. – “Misallocation” of resources – The Fund also warns against Beijing's strong support for certain strategic industrial sectors, because this could cause a “misallocation “resources, harmful to trade. “Reducing these policies and removing restrictions on trade and investment would increase national productivity and to mitigate the risks of fragmentation” of the market, according to the IMF. US Treasury Secretary Janet Yellen in Washington, April 19, 2024 © AFP – SAUL LOEB China has been under pressure for several months over supposed “overcapacity” in part of its industry. A situation denounced in particular by the United States as being the result of excessive subsidies. American Secretary of the Treasury Janet Yellen called last week on the G7 to constitute “a clear and united front” in the face of China's “industrial overcapacity”, which generates “macroeconomic imbalances”, requiring “responses” from the affected countries. The G7 Finance Ministers have announced that they are “considering taking measures” on this subject. – Need for “structural reforms” – In the medium term, “growth is expected to slow to 3.3% due to the aging of the population and the slowdown in productivity gains”, detailed Gita Gopinath, Deputy Managing Director of the IMF, at during a press conference in Beijing. Gita Gopinath, number two of the International Monetary Fund (IMF), speaks during a press conference in Beijing, May 29, 2024 © AFP – WANG Zhao The IMF number two also highlighted “the significant budgetary challenges, particularly for local governments”, facing the country, adding “that sustained medium-term budgetary consolidation is necessary” . Beijing came to the aid of China's crisis-ridden real estate sector in May, by reducing the minimum down payment required for first-time home buyers. Local governments will also be able to purchase unsold real estate. This is one of the most ambitious measures taken by Beijing to get the sector out of a serious debt crisis, which has pushed many developers into bankruptcy. Several cities, including Shanghai, have also eased some restrictions on purchasing real estate. But the IMF said on Wednesday that China needed ” structural reforms to combat headwinds and address underlying imbalances.” “The first priorities are the rebalancing of the economy towards consumption, in strengthening the social safety net and liberalizing the services sector to enable it to stimulate growth potential and create jobs”, underlined the Fund. All rights of reproduction and representation reserved. © (2024) Agence France-Presse