© Mintos

If you want to grow your assets by investing in innovative financial products from 50 euros, it's possible thanks to Mintos. Launched in 2015, the European platform has succeeded in making itself known by offering credible long-term investments. Whether you are a novice investor or an expert wishing to diversify your portfolio, the service is for everyone. This is the perfect opportunity to go into more detail about this very comprehensive offer and to explain to you why it has everything to please.

Why choose Mintos for your investments?

Investing money can sometimes be intimidating and even scary, and Mintos understands this. The platform is thus authorized within the framework of the European MiFID regulation, and it has a protection system for each client. The latter notably covers situations often due to operational errors. Thus, you will be able in certain cases to recover 90% of your net loss for a maximum of 20,000 euros. That's always good to know.

Joining Mintos means putting your trust in a company that is almost 10 years old and has already gathered more than 500,000 users. They salute the seriousness and professionalism of its teams present in Europe.

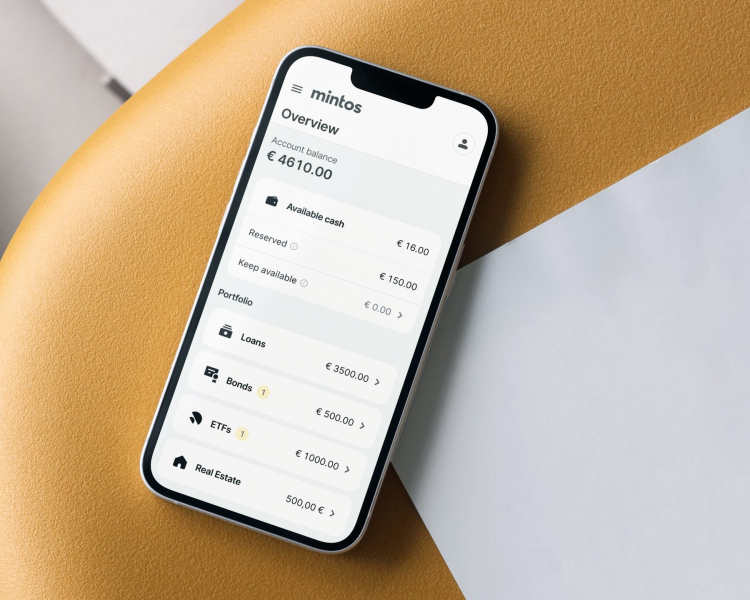

The service also convinces with its ease of access. You can register for free and without any fees or commission. With a minimum investment of 50 euros, Mintos democratizes access to financial investments. The mobile application is intuitive and focuses on its ease of use. It allows you to create your portfolio and track your investments wherever you are, at any time.

Even better ? Mintos really adapts to all profiles. If you are just starting out, there are many resources available online for you to consult. Mintos employees are available to answer all your questions, by telephone or email, but also via the chatbot. For more experienced investors, the platform allows you to build your investment with alternative or more traditional asset classes. You will then be able to follow the evolution of your portfolio in real time.

The ideal platform for loans

Mintos positions itself as the leading platform for loan investment in Europe. From individual loans to small businesses, you can build attractive returns over the long term.

In detail, the service offers Mintos Core, which is its flagship offering. This wallet is fully automated and diversified and requires little effort to set up for an average interest rate of 10.8% over the past few years.

As for Mintos Custom and manual investment, you can set up automated investment strategies according to selected criteria. The current interest rate here is much more variable and ranges from 5 to 21%.

Bet on Fractional Bonds for high returns

While high-yield bonds are traditionally reserved for institutional investors or wealthy individuals, Mintos makes these investments accessible to everyone from 50 euros, without any commission to pay. That's always a good thing!

Note that with fractional bonds, clients benefit from regular and fixed returns. All this is done with complete traceability and transparency, because these products have a unique international securities identification number (ISIN).

Bet on ETFs, whatever your profile

The platform offers personalized ETF portfolios based on your profile and financial goals. The latter, made up of stocks and bonds, come from renowned providers such as Amundi, iShares, JP Morgan, Vanguard, whose reputation is well established worldwide. All without any commission being charged for investment and sales. A particularly appreciable specificity of the service, as the costs of certain competitors sometimes tend to soar

In addition, Mintos supports tax-efficient rebalancing, automatically choosing tax-optimized ETFs. Your portfolios will thus be adjusted as your investments increase.

As you will have understood, Mintos really has what it takes to appeal to a very wide audience. With its many assets and diversified products, it positions itself as asolid reference in the sector which redefines the investment experience of the French.

Investing in financial instruments involves risks. No guarantee of recovery of the amount invested. Past performance does not guarantee future results. Historical returns, expected returns or probability projections may not reflect actual future performance.

📍 To not miss any news from Presse-citron, follow us on Google News and WhatsApp.

In partnership with Mintos